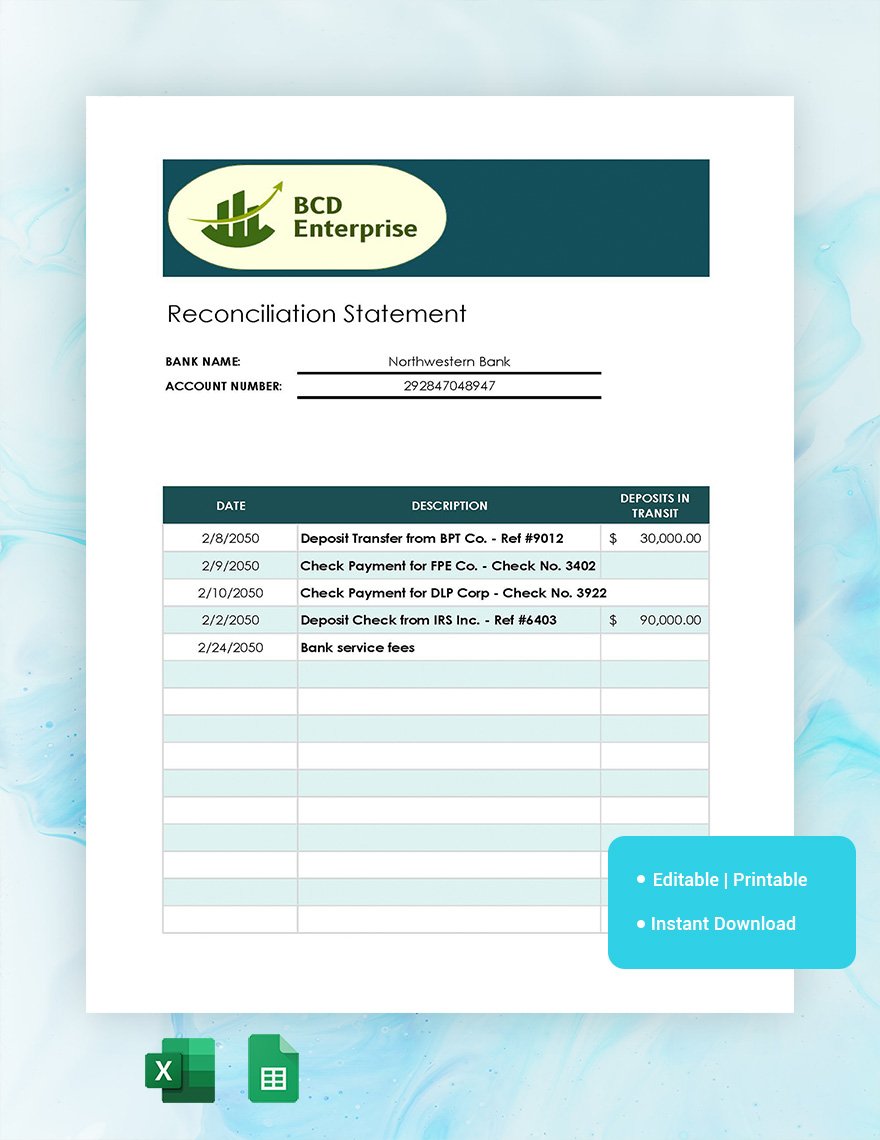

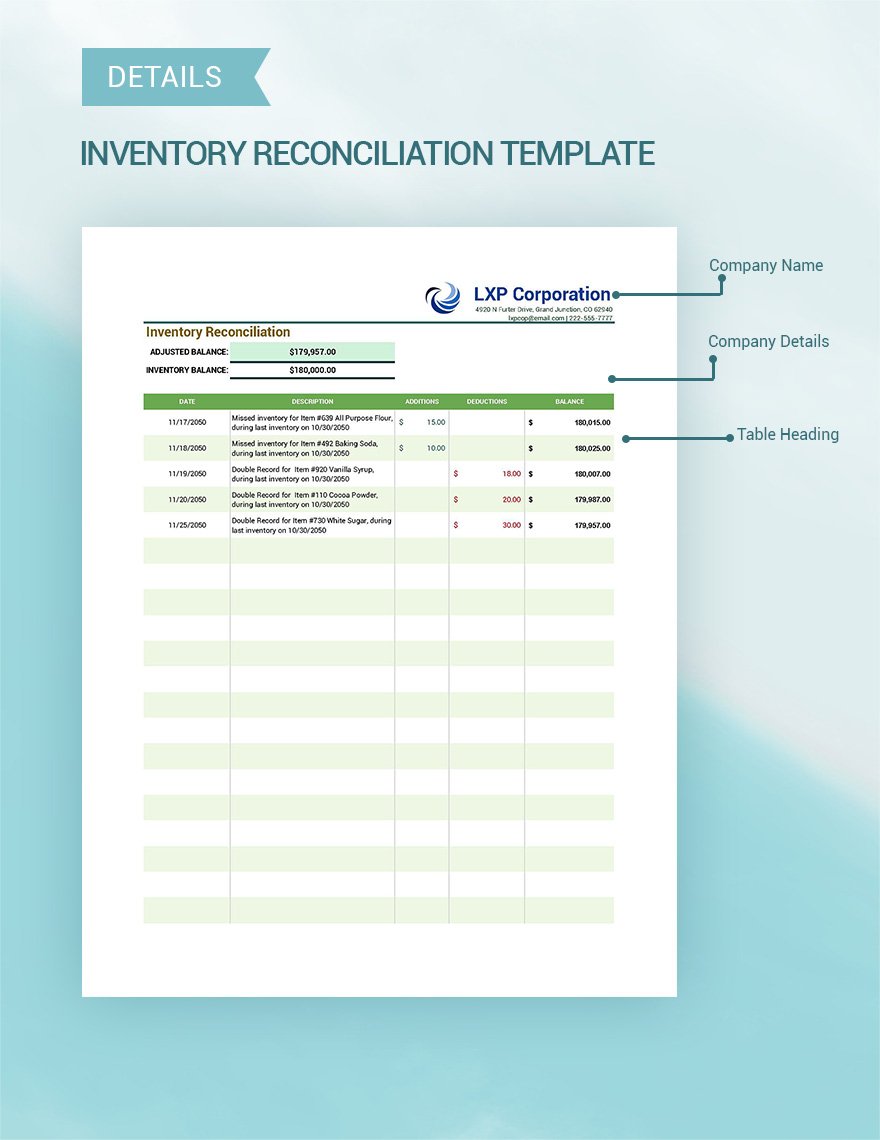

It’s all about matching up numbers to make sure everything adds up correctly. Whether you’re balancing a checkbook or reconciling accounts for a business, understanding how to craft a well-organized reconciliation report in Excel can save time and reduce errors. accounting for construction companies Based on this example, you may decide that Option C is the best choice for your business, as it offers the most value and meets your needs and budget. Of course, this is just a hypothetical scenario, and you may have different preferences and criteria.

Why Reconcile Cost Accounts and Financial Accounts?

In the realm of financial management, the reconciliation of costs stands as a pivotal process, ensuring that the recorded figures align precisely with the actual expenditures incurred. This meticulous task, traditionally labor-intensive and prone to human error, has been revolutionized by the advent of sophisticated technological tools. These innovations not only streamline the process but also enhance accuracy and provide real-time insights into financial data. In the realm of financial management, reconciling costs poses a myriad of challenges that can perplex even the most seasoned professionals. The process, inherently complex, involves aligning internal records with external statements to ensure accuracy and transparency.

Step 3 of 3

Automatically calculate and update CVR and produce CVR reports at the click of a button with Access Coins, the ERP built for construction. The report often includes all the received amounts, as well as any potential incomes at the end of the project. As of November 1, 2024, we had the following crude oil production and gas purchases hedges.

More construction software information, guidance and advice

For example, the cost reconciliation process should be performed at the end of each project phase, milestone, or deliverable, to ensure that the actual cost incurred is consistent with the planned or budgeted cost. This can help identify and resolve any cost discrepancies or inconsistencies as soon as possible, and prevent them from accumulating or escalating over time. It can also help monitor and control the project cost performance and variance, and provide timely and accurate feedback and recommendations for corrective actions.

- Free Cash Flow(1) in the third quarter of 2024 was slightly higher than the third quarter of 2023, while both Cash Flow from Operations and capital expenditures increased.

- From setting up your workbook to using formulas and conditional formatting, each step plays a vital role in ensuring your report is accurate and insightful.

- This can occur when transactions are missing or when records aren’t updated in a timely manner.

- Businesses that follow a risk-based approach to reconciliation will reconcile certain accounts more frequently than others, based on their greater likelihood of error.

Irrelevant data being mixed, data that is incomplete or with a wrong date, formatting errors, and incorrect synthesis of numbers. Access Coins CVR captures data already on the platform to produce flexible CVR reports on demand, with a full audit trail, while still allowing surveyors to make adjustments if required. The completed CVR can be produced in various report formats or reviewed online via dashboards. The Access CVR module streamlines preparing CVRs through integration to the centralised Access Coins database for quick and accurate collation, reconciliation, and corroboration of the data.

Through this rigorous process, organizations can maintain financial integrity, providing stakeholders with the confidence that resources are being managed responsibly. It’s not just about balancing the books; it’s about painting an accurate picture of a company’s financial health and ensuring that picture is as clear and reliable as possible. The fourth step is to execute the corrective actions according to the plan and the schedule. This may involve communicating, coordinating, delegating, or documenting the changes. The changes should be implemented with care and accuracy to avoid further errors or inconsistencies.

This may involve collecting, analyzing, or reporting the data and the feedback. The results should be compared with the expected cost and the performance indicators of the project or process. If the results are satisfactory, the corrective actions are successful and the inconsistencies are resolved.

In this case, we may have a different percentage of completion for the raw materials and the conversion costs. Conversion costs are defined as direct labor plus manufacturing costs needed to finish a product. Under-absorption of indirect expenses occurs when the amount charged for indirect expenses in financial accounts is lower than the amount actually incurred. Data connectivity solutions provide a powerful tool to keep cost and financial accounts in sync.

Once the project begins, tracking all ongoing expenses can become daunting since data from various sources needs to be gathered, sorted, and tracked. Inadequate expense tracking is one reason construction firms report higher costs than anticipated. Along with meticulous expense tracking to support CVR, carefully selected KPI targets help monitor project performance, identify cost inefficiencies early, and provide clear insights that can lead to quick course corrections. Each cost value reconciliation report should provide a self-explanatory summary of the construction project’s financial standing. The introduction and summary sections help to set the stage and give some context for the report, along with a brief project summary and timeline. The report should highlight any identified risks or other areas requiring immediate attention.